The global energy landscape is undergoing a seismic shift. As climate change concerns intensify and technologies advance, the world is steadily transitioning from fossil fuels to renewable energy sources. For countries whose economies heavily rely on oil, gas, or coal revenues—commonly referred to as fossil fuel states—this evolution poses both an existential challenge and a transformative opportunity.

Fossil fuel-rich states are now navigating an era defined by decarbonization, net-zero targets, and energy diversification. While the response varies from state to state, many are actively adapting by investing in clean energy infrastructure, diversifying their economies, reforming subsidies, and participating in global sustainability frameworks.

This article explores how fossil fuel states are adjusting to renewable energy trends, focusing on case studies, challenges, and strategic pathways being developed to ensure resilience and relevance in a rapidly changing energy environment.

1. The Global Push Toward Renewables

Over the past decade, renewable energy sources such as solar, wind, hydro, and green hydrogen have gained momentum due to:

-

Falling technology costs

-

Climate change mitigation targets (e.g., Paris Agreement)

-

Energy security concerns

-

Public and investor pressure

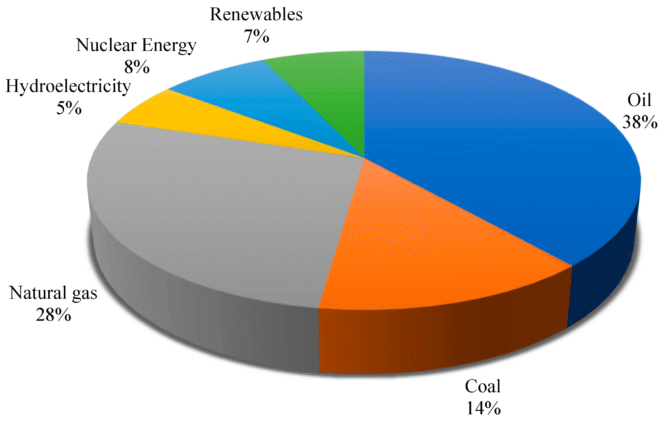

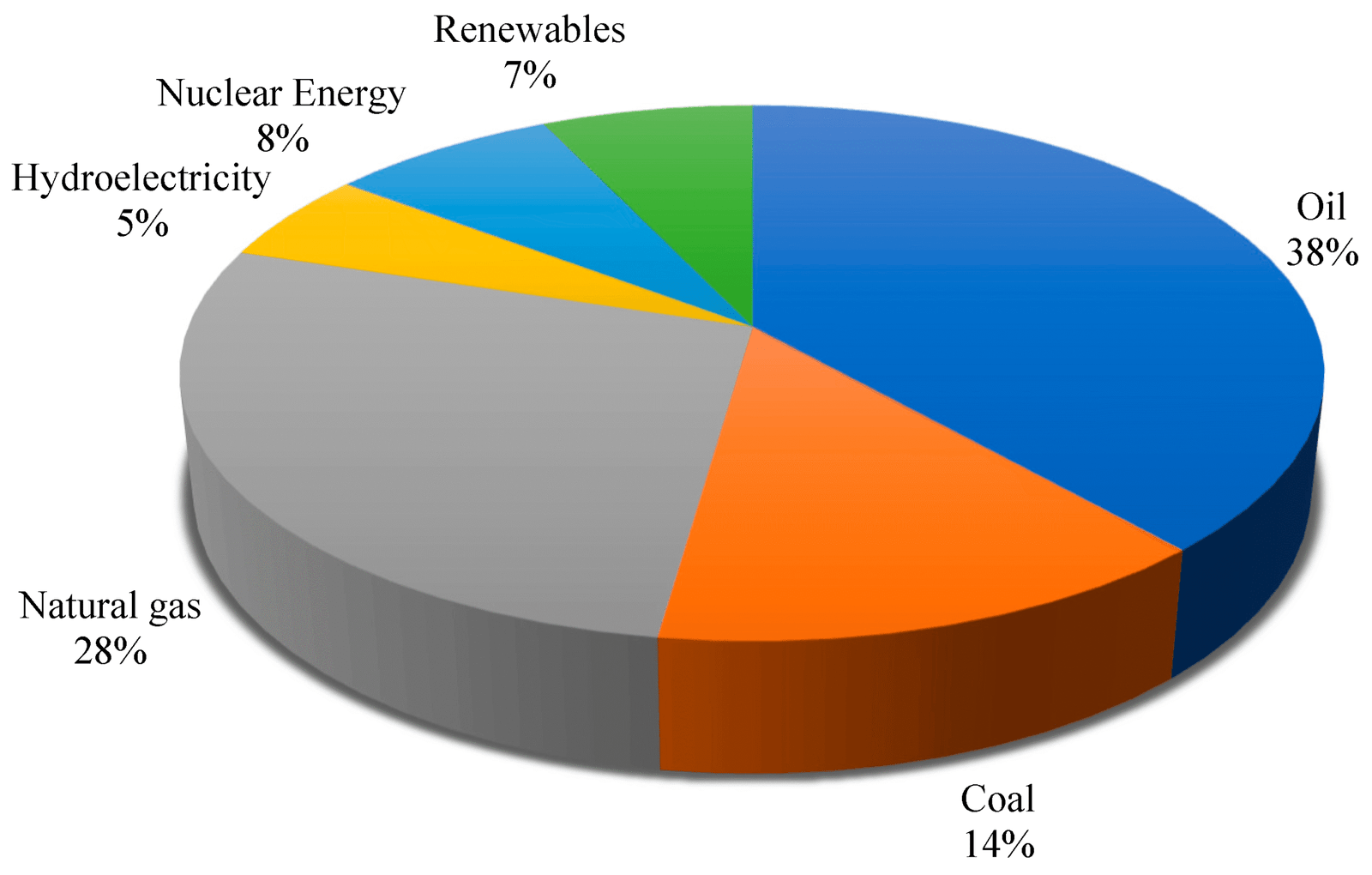

According to the International Energy Agency (IEA), renewable energy accounted for almost 90% of global electricity capacity expansion in 2023. For fossil fuel states, this shift translates to potential declining demand for oil and gas exports, threatening national budgets, employment, and geopolitical influence.

2. Gulf Cooperation Council (GCC) States: Leading the Transition in Oil-Rich Economies

The GCC nations—Saudi Arabia, the United Arab Emirates (UAE), Qatar, Kuwait, Bahrain, and Oman—are among the world’s top hydrocarbon exporters. Yet, they are also emerging as key players in the renewable transition.

Saudi Arabia

-

Vision 2030: A sweeping economic diversification plan to reduce dependency on oil.

-

NEOM & The Line: A futuristic $500 billion smart city powered entirely by renewable energy.

-

Green Hydrogen: Saudi Arabia is building one of the world’s largest green hydrogen plants in partnership with Air Products and ACWA Power.

United Arab Emirates

-

Net Zero by 2050: First Gulf country to commit to a net-zero emissions goal.

-

Masdar City: An ambitious clean tech and renewable energy hub in Abu Dhabi.

-

Nuclear Energy: The Barakah nuclear plant is part of the UAE’s low-carbon diversification strategy.

Qatar

-

Focuses on carbon capture and storage (CCS) and solar energy, while still heavily relying on LNG exports.

-

Invests in global renewable energy projects through its sovereign wealth fund.

These countries are leveraging their financial power, sovereign wealth funds, and strategic planning to pivot toward renewables while maintaining fossil fuel operations in parallel—an approach often described as a “dual-energy strategy.”

3. Norway: The Model Fossil Fuel State Transitioning Responsibly

Norway, a major oil and gas producer, stands out as a leader in sustainable transition:

-

Electric Vehicles (EVs): Over 80% of new car sales are electric, thanks to strong government incentives.

-

Renewable Electricity: Nearly 100% of electricity generation comes from hydropower.

-

Oil Fund (Government Pension Fund Global): The world’s largest sovereign wealth fund has divested from coal and invested in green energy technologies.

-

Carbon Pricing: Norway implements one of the highest carbon taxes globally.

Norway shows how sound governance, policy alignment, and public support can harmonize fossil fuel wealth with climate responsibility.

4. The United States: A Divided Yet Transforming Landscape

As the world’s largest oil and gas producer, the United States faces internal divisions in its energy trajectory:

Federal Level

-

The Inflation Reduction Act (IRA) allocates over $370 billion for clean energy and climate programs.

-

Focuses on onshore wind, solar, EV incentives, battery manufacturing, and green hydrogen.

State-Level Initiatives

-

Texas: While a major oil state, it leads the U.S. in wind energy capacity.

-

California and New York: Aggressive renewable energy targets and carbon neutrality laws.

Private Sector

-

Fossil fuel giants like ExxonMobil and Chevron are investing in carbon capture, biofuels, and renewable partnerships, albeit gradually.

Despite political polarization, the U.S. shows how market forces, innovation, and state-level action can push even traditional fossil economies toward cleaner energy futures.

5. Russia: Limited Transition, Growing Pressure

Russia’s economy is deeply tied to oil and gas exports, especially to Europe and Asia. However, its response to renewable trends has been slow and reactive.

-

Energy Strategy to 2035: Emphasizes maintaining fossil fuel dominance.

-

Limited Investment in Renewables: Less than 1% of electricity comes from solar or wind.

-

Green Hydrogen Exports: Recently explored due to pressure from trading partners like the EU.

Sanctions, geopolitical tensions, and an aging energy infrastructure have constrained Russia’s ability to diversify. Yet, climate pressures and export dependencies may eventually force a pivot.

6. African Fossil Fuel States: Between Opportunity and Risk

Countries such as Nigeria, Angola, and Algeria face unique challenges:

-

High economic reliance on oil and gas revenues (up to 90% of exports)

-

Underdeveloped infrastructure and energy access gaps

-

Rising youth populations demanding jobs and electricity

Nigeria

-

Launched the Energy Transition Plan (ETP) aiming for net-zero by 2060.

-

Focuses on solar mini-grids, off-grid solutions, and gas-to-power projects.

-

International funding and technology transfers are critical for progress.

Africa’s fossil fuel states walk a tightrope—needing hydrocarbon revenues for development while also seeking to leapfrog into a green, decentralized energy future.

7. Latin America: Fossil Fuel Producers Embracing Renewables

Some Latin American countries with significant fossil fuel reserves are also emerging renewable leaders.

Brazil

-

A global ethanol pioneer via sugarcane biofuels.

-

Hydropower supplies over 60% of electricity needs.

-

Rapid solar expansion in recent years.

Mexico

-

Has faced criticism for rolling back some clean energy reforms.

-

However, Pemex, the national oil company, has started exploring clean hydrogen.

Argentina

-

Investing in wind farms and lithium mining, essential for battery technology.

This dual approach illustrates how fossil fuel states can capitalize on their renewable potential without abrupt abandonment of oil and gas industries.

8. Tools of Adaptation: How States Are Evolving

Fossil fuel states are adopting various strategies to transition smoothly, including:

A. Economic Diversification

Reducing dependency on hydrocarbons by investing in:

-

Tourism (e.g., UAE, Saudi Arabia)

-

Finance and tech hubs (e.g., Bahrain)

-

Agriculture and manufacturing (e.g., Nigeria)

B. Renewable Investment

Building domestic capabilities in:

-

Solar and wind farms

-

Hydrogen production

-

Energy storage and smart grids

C. Green Finance and ESG

Issuing green bonds, creating carbon markets, and aligning with Environmental, Social, and Governance (ESG) principles to attract sustainable investment.

D. Education and Workforce Training

Developing human capital to support clean energy sectors through:

-

STEM education

-

Vocational training

-

Green entrepreneurship programs

E. International Cooperation

Participating in:

-

COP summits

-

Multilateral climate finance mechanisms

-

Bilateral clean energy partnerships

9. Challenges and Risks on the Road Ahead

Transitioning to renewables is not without its obstacles, especially for fossil fuel-reliant economies.

A. Revenue Shortfalls

Reduced fossil fuel demand could create budget deficits, particularly in states without sovereign wealth buffers.

B. Social Resistance

Job losses in fossil fuel industries and lack of trust in green policies can spark public unrest.

C. Infrastructure Gaps

Many countries lack the transmission grids, storage solutions, and regulatory frameworks to scale renewables quickly.

D. Greenwashing Risks

Some fossil fuel states may adopt the language of sustainability without implementing substantive reforms.

10. The Future: Coexistence or Complete Transition?

Experts believe that a hybrid energy future is likely for several decades, where:

-

Oil and gas continue to play a role, particularly in aviation, shipping, and petrochemicals

-

Renewables dominate electricity, transportation, and residential sectors

-

Carbon capture, clean hydrogen, and negative emissions technologies bridge the gap

The key lies in managing the transition to minimize disruption while maximizing innovation, resilience, and global cooperation.

Conclusion

Fossil fuel states stand at a critical crossroads. Whether they thrive or falter in the age of renewables depends on their ability to anticipate trends, invest wisely, reform institutions, and engage global partners. Some, like Norway and the UAE, are charting proactive paths. Others are lagging, risking economic stagnation and environmental backlash.

Yet, the momentum is clear: the renewable revolution is not a distant dream but an unfolding reality. For fossil fuel states, the challenge is no longer whether to adapt—but how fast, how equitably, and how sustainably they can do so.